LG Ends LCD TV Panel Production in Korea

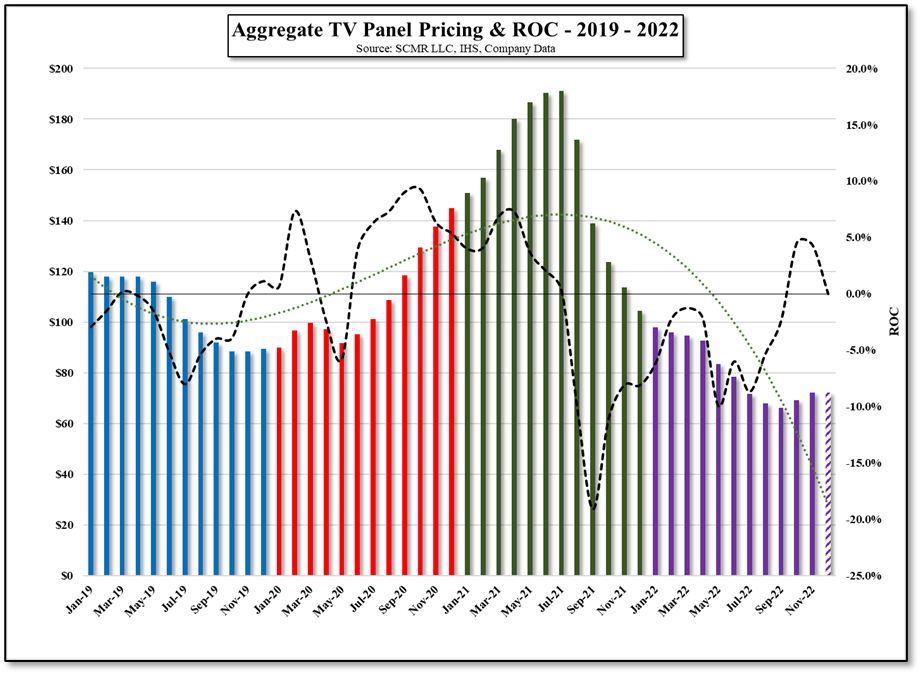

LG Display has expressed its intentions to reduce or eliminate LCD TV panel production in South Korea in the past, however the rise of TV panel prices during the COVID-19 pandemic in 2020 and 2021 , gave them reason to postpone those changes, likely with encouragement from parent LG Electronics (066570.KS), who, along with most other TV set manufacturers faced short supply from other sources. Since last July the price of LCD TV panels has declined precipitously, making the decision a bit of an assumption.

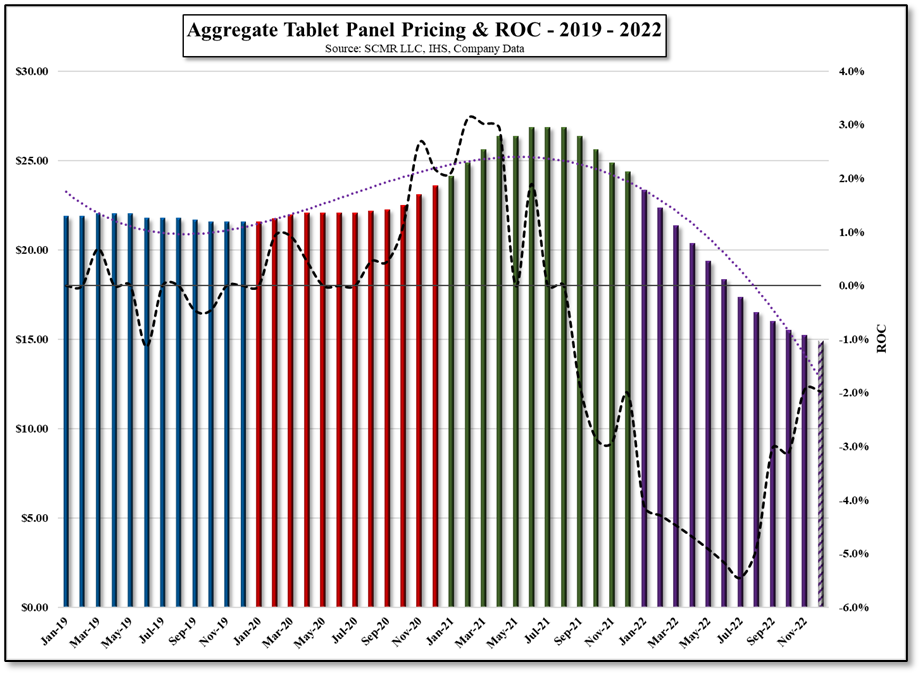

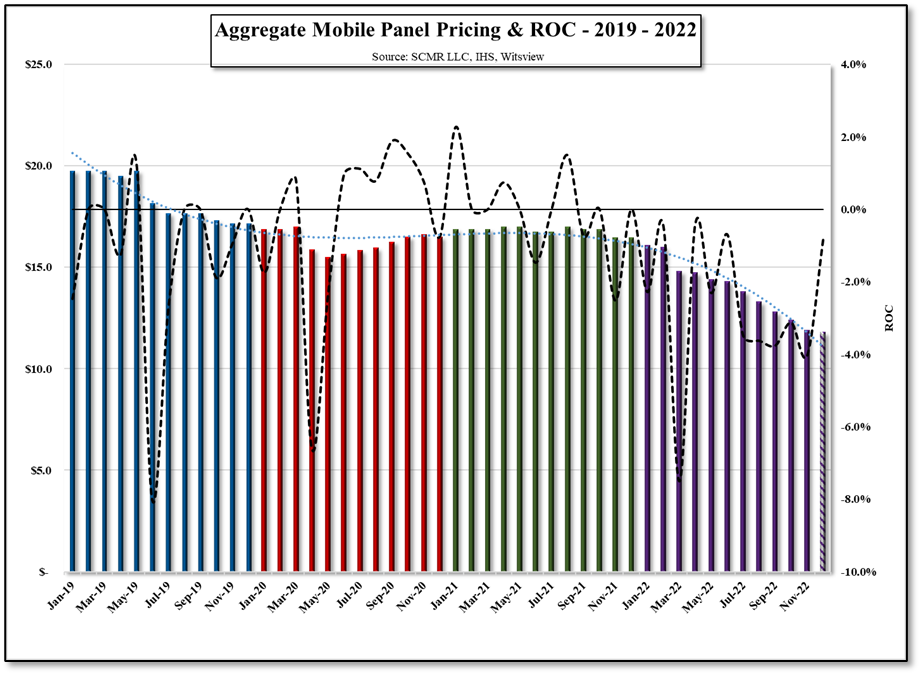

Both Samsung Display and LG Display have been facing aggressive competition from Chinese panel producers, who are able to produce generic LCD TV panels less expensively due to lower labor costs and government subsidies. In recent quarters, LG Display, along with other non-Chinese panel producers, have shifted away from direct competition with the Chinese and tried to change their mix toward higher margin more specialized products. While this has offered a bit of protection from competition, weakness in the overall display market has lessened the benefits of those changes and pushed LGD and potentially others to restructure fabs in order to maintain a profitable mix.

Some have moved toward OLED, which we expect will be the case for LG Display in the future, converting P7 to either an OLED IT panel fab or an OLED TV panel fab, but given the current macro circumstances, such decisions can wait for a quarter or so to see how the holidays pan out and what the longer-term picture might be. While it is expensive to have an idle fab of the size of P7, it is certainly less expensive than running it at low utilization rates or producing at cash costs or below, so the decision was imminent, although we will have to wait until January to get more information on how quickly the implementation will take place, the cost, and if any plans for the future of the fab have been made.

RSS Feed

RSS Feed